The cryptocurrency market lives in cycles: periods of accumulation, early growth, euphoria, and subsequent correction. Understanding the sequence of phases helps not only to "guess" the moment of entry, but also to build exit discipline: to fix profits, preserve capital, and not turn volatility into a threat. In this article, we will explain in simple terms how cycles work, which metrics will really help in 2025–2026, and provide a step-by-step algorithm: how to enter, how to hold your position, and how to exit without losing your head in the information noise.

What is a market cycle and how to recognize it

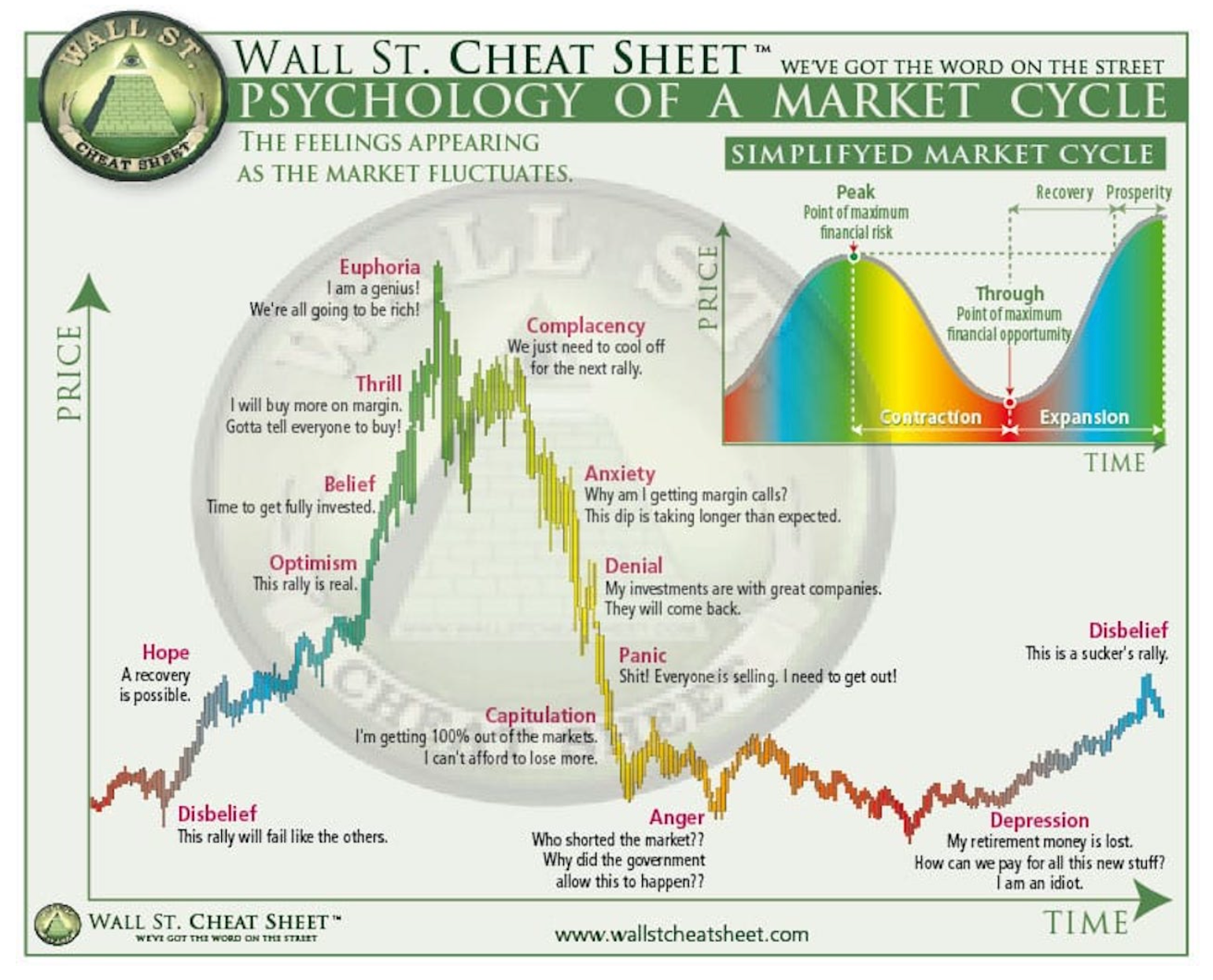

The cycle begins with an accumulation phase: while the price is "sleeping," interest is low, and institutional and patient participants are buying up. Then comes the early bullish trend: the first new highs appear, volumes grow, and on-chain signs of demand intensify. Euphoria is the culmination of the cycle: price acceleration, a surge in retail interest, "crypto everywhere." After that, there is a cooling off and a bearish phase: liquidation of leveraged positions, a decline in active liquidity, and a gradual leveling off of valuations. The investor's task is not to guess every candle, but to understand what phase we are in and act according to plan.

Source: bybit.com

Key metrics and cycle signals in 2025–2026

In 2025–2026, metrics that directly reflect capital behavior, miner activity, and pressure from derivatives will be important for assessing the phase of the Bitcoin cycle. The first thing to look at is on-chain flows: net inflows and outflows of coins from exchanges. Systematic inflows to centralized exchanges often precede profit-taking phases, while sustained outflows to cold wallets indicate accumulation and a decline in supply liquidity.

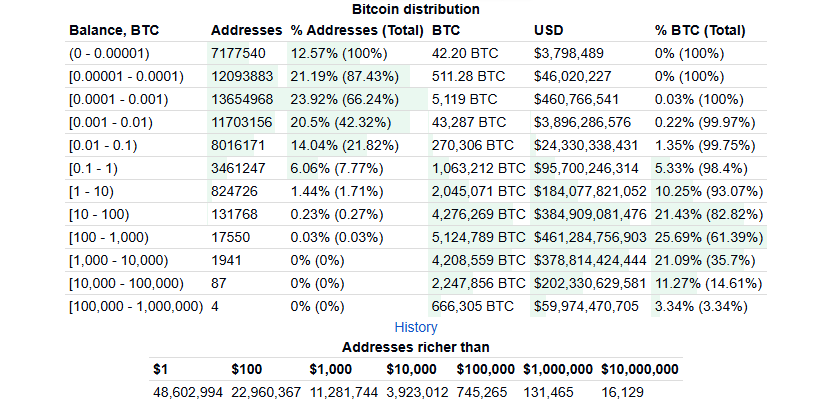

"The concentration of on-chain balances and withdrawal patterns on exchanges remain key indicators for assessing supply pressure." — ChainalysisThe second important signal is the behavior of long-term holders, or whales: changes in the share of coins that have not been moved for a year or more, and the age of unrealized profits. If long-term holders are building up their positions, this is a sign of fundamental confidence; if they start selling, it is an alarming signal.

Source: bitinfocharts.com

The third set of metrics is related to miners: total hashrate, difficulty, miner revenue, and hashprice — revenue per unit of hashrate. A sharp drop in miner revenue amid stable or growing difficulty indicates pressure on miners and possible sales of their reserves. Analysis of miners' balances (how much BTC they have in their wallets) and their transfers to exchanges is a direct indicator of potential sales.

Source: bgeometrics.com

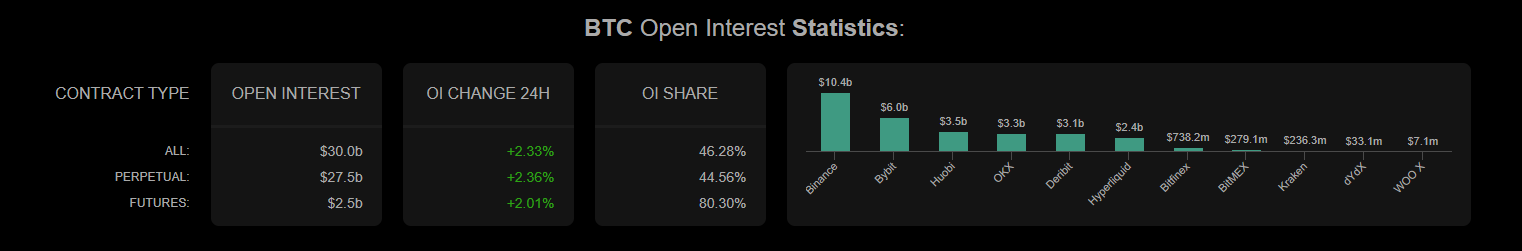

The fourth signal is derivatives and liquidity: the funding rate on futures, open interest, and the ratio of spot volume to derivatives volume. A positive and stable funding rate with growing open interest often accompanies euphoric phases; a sharp surge in funding and leverage concentration increases the risk of sudden liquidations and deep corrections. Finally, the macro context — interest rates, the dollar, and institutional capital inflows (ETF flows) — sets the stage: in 2025–2026, institutional ETFs and large buyers may prolong bullish phases, but regulatory news can quickly change market sentiment.

Source: coinalyze.net

"Institutional flows through ETFs and large purchases can prolong bullish phases, but sharp inflows/outflows on exchanges remain the main short-term price catalyst." — CoinDesk

How to apply these signals in practice: entry and exit (step by step)

The first rule is to look at a combination of indicators, not just one. To enter Bitcoin, we look for a combination of: steady outflows from exchanges + growth in the share of long-term holders + stable or growing hash price and no overheating in derivatives (moderate open interest and neutral funding rate). When all three factors converge, it is a signal for a gradual entry using DCA. We divide the entry into parts: the first part upon confirmation of accumulation, the subsequent parts as the early trend is confirmed (growth in volume and breakthrough of key levels).

For exit, we use predefined rules: partial fixation by targets (for example, 20-30% of the position at each of the three levels), automatic risk reduction when signs of overheating appear (sharp increase in the funding rate, massive inflows to exchanges, abnormal sales by long-term holders), and a time plan (for example, fixing part of the position when quarterly targets are reached). An important point: exiting is not panic, but risk management. If derivatives show excessive leverage and open interest is growing faster than prices, this is a reason to reduce exposure, even if the trend has not yet broken.

For Bitcoin in 2025–2026, the key signals are on-chain flows, the behavior of long-term holders, miner metrics, and the state of derivatives. We make entries using DCA when accumulation and an early trend are confirmed; exits are made according to pre-set targets and when there are signs of overheating. Always link on-chain data with market liquidity and derivatives: only the combination gives a reliable signal, not a single metric.

Three behavior scenarios and what to do in each

- Accumulation → early growth: outflows from exchanges, growth of long-term holders, stable hash price. Action: launch DCA, a small portion in cash buffer, plan to lock in profits according to targets.

- Euphoria: sharp price growth, positive and high funding rate, open interest growing faster than prices. Action: partial profit-taking, tightening stops, reducing leverage and limits on altcoins.

- Overheating → correction: massive inflows to exchanges, sales by long-term holders, fall in miner revenue. Action: actively reduce risk, transfer part of the position to stablecoins, wait for confirmation of accumulation before re-entering.

In addition to buying BTC on an exchange, you can get Bitcoin through cloud mining: rent computing power from GoMining, pay for the contract, and receive daily BTC accruals to your account. Advantages: no need to buy and maintain equipment, no need to deal with placement and cooling issues, you see transparent profitability statistics and can sell part of your accruals at any time. GoMining provides an interface for power management, automatic payments in BTC, and options for withdrawal or sale through integrated services.

Subscribe and get access to the (still) free GoMining course on crypto and Bitcoin

Telegram | Discord | Twitter (X) | Medium | Instagram

FAQ

- What is Market Cycles 101: how and when to enter and exit Bitcoin? This is a practical technique that describes the phases of the market — accumulation, early growth, euphoria/distribution, and decline — and provides rules for timing entries and exits: how to recognize the phase, how to split the entry (DCA), when to fix part of the position, and how to reduce risk when there are signs of overheating.

- How does this methodology work in crypto? It combines price behavior with on-chain signals and derivatives metrics: observing inflows/outflows on exchanges, long-term holder activity, hashrate and miner assets, funding, and open interest. If the signals confirm each other, then a decision is made to enter or partially lock in.

- What are the advantages and risks of this approach? Advantages: discipline, reduction of emotional errors, more predictable returns over long cycles. Risks: false signals, macro shocks, prolonged sideways movements, as well as the risk of misinterpreting metrics (e.g., short-term outflows as the beginning of a sell-off).

- How to use Market Cycles 101 in 2025? In 2025, focus on a combination of: sustained outflows from exchanges + growth in the share of long-term holders + stable hash price and moderate derivatives. Enter using DCA, lock in a portion of your profits at predetermined levels, and monitor institutional flows (ETFs) as an additional factor.

- What metrics are associated with this methodology? Key metrics: inflows/outflows to exchanges, share of long-term holders, hash rate and miner revenue (hash price), funding and open interest in futures, spot volumes, and liquidity at key levels.

- Can you make money using this methodology? Yes, with discipline and proper implementation of DCA + phased profit-taking, the methodology has historically provided an advantage over emotional timing. But profitability depends on macro conditions, liquidity, and proper risk management.

- What mistakes do beginners make? Common mistakes include chasing peaks, ignoring on-chain confirmations, excessive use of leverage, lack of an exit plan, and attempts to "catch up" with the price after a strong correction.

- How does the methodology affect the cryptocurrency market? When many participants act in cycles, their collective behavior smooths out extremes: accumulation during drawdowns and fixation during rallies form the amplitude and duration of cycles. Mass actions (e.g., profit-taking) can amplify corrections.

- What do experts predict for 2026? Experts expect institutional flows and macro liquidity to remain key drivers: if ETF inflows continue, extended bullish phases are possible; if macro conditions tighten, deeper and longer corrections are possible. Specific scenarios depend on capital inflows and regulatory events.

- Where can you follow updates on Market Cycles 101 and signals for Bitcoin? Track on-chain analytics (Glassnode, CryptoQuant), hashrate and miner revenue charts (BitInfoCharts, Blockchain.com), derivatives dashboards (Binance Research, Skew/CoinGlass), and ETF/institutional flow reports (CoinDesk, Cointelegraph). Check multiple sources and note the date of the data before making a decision.

NFA, DYOR.

The cryptocurrency market operates 24/7/365 without interruptions. Before investing, always do your own research and evaluate risks. Nothing from the aforementioned in this article constitutes financial advice or investment recommendation. Content provided "as is", all claims are verified with third parties and relevant in-house and external experts. Use of this content for AI training purposes is strictly prohibited.

Practical guide "How and when to enter and exit Bitcoin": recognizing market phases, key on-chain metrics, DCA, risk management, and scenarios for 2025–2026.

December 3, 2025