Crypto trading offers huge opportunities — but without strong security, your assets are only one click away from being stolen.

Highlights

- Crypto security is critical because you are the first and last line of defence

- Major risks: exchange hacks, phishing, malware, social engineering, insecure wallets

- Best practices: strong passwords, 2FA, cold storage, software updates

- Safe trading requires reliable platforms with transparency, insurance, and regulation

- Scams evolve quickly — awareness and vigilance are your strongest protection

Understanding Crypto Security

Crypto isn’t like a bank. There’s no “forgot my password” button, no customer support line, and definitely no refunds if things go sideways. When you buy crypto, you’re the bank — private keys = full control. And yeah, that freedom is 🔥… but it also means if you mess up, your coins can disappear forever.

Here’s the catch: the risks are real and they don’t care if you’re new or pro.

1. Exchange Hacks

Even top exchanges get hit. If you leave all your coins there, you’re gambling with your future. Keep only what you trade — move the rest somewhere safe.

2. Phishing Scams

One fake email or site = instant loss. Always double-check links, and never share your keys. If it feels rushed or “urgent,” it’s probably a trap.

3. Malware & Keyloggers

Hackers don’t knock — they sneak in. Hidden software can record every click and drain your wallet. Updates + protection = non-negotiable.

4. Social Engineering

Scammers play people, not code. They’ll pretend to be support, friends, or influencers. Trust actions, not words — and never hand over private keys.

If you’re in crypto, security isn’t optional — it’s survival. Lock it down from day one, or risk losing everything faster than you can say “to the moon.”

Why Good Security Wins ✅

Lock your setup (you stay in control).

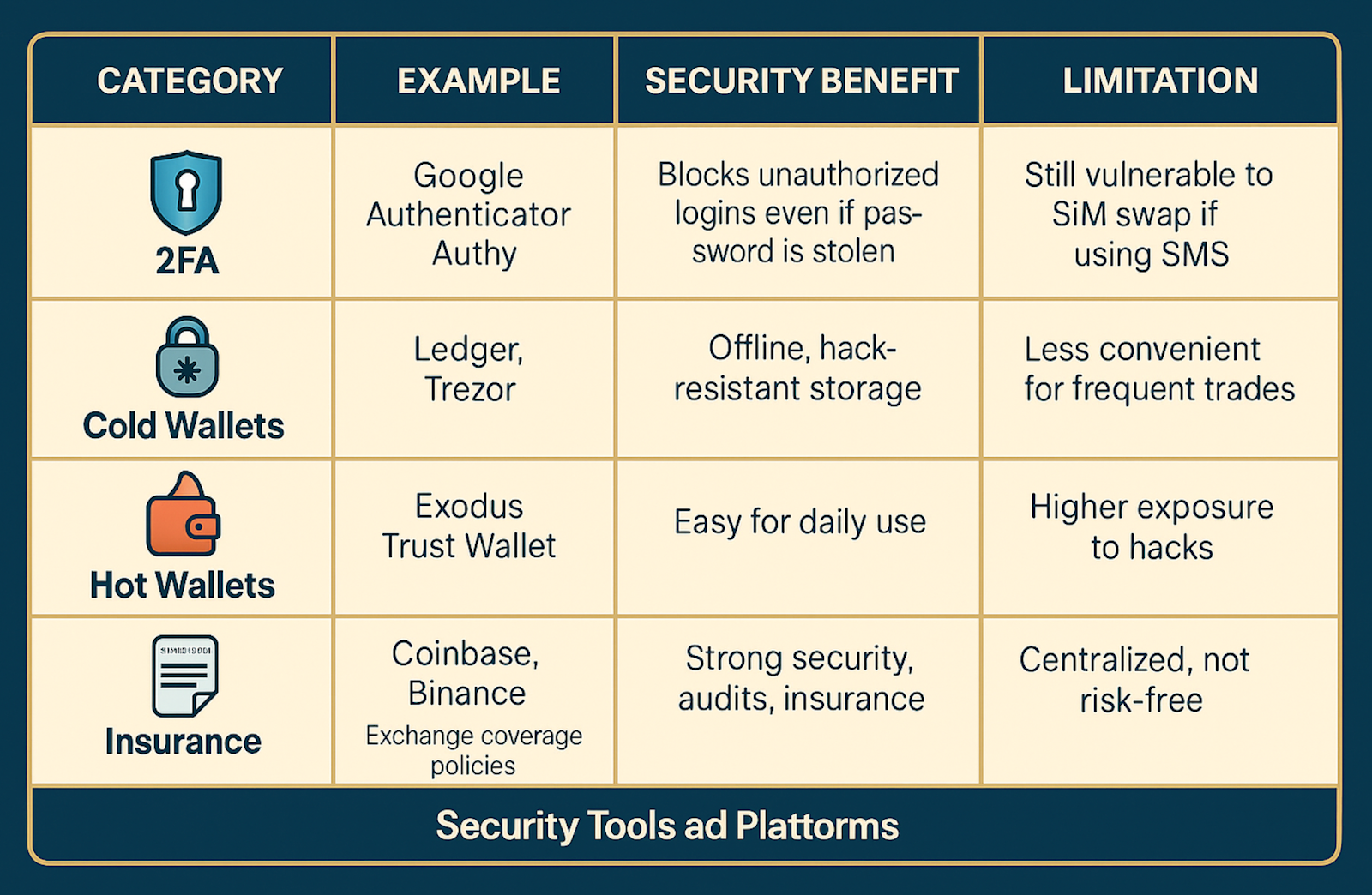

Use 2FA, unique passwords, and a cold wallet for your long-term bag.

Hot wallets = speed for daily moves; cold wallets (Ledger/Trezor) = offline vault for value.

Most pros run a hybrid: small balance hot, the rest cold.

Result: you control access, not a helpdesk.

Pick safe venues (you lower your exposure).

Trade on reputable, regulated platforms that publish audits, keep funds in cold storage, and offer insurance. KYC/AML may feel tedious, but it cuts fraud and boosts platform reliability.

Translation: less anxiety, more focus on growing your stack.

Confidence compounds.

A secure setup means fewer “is this link safe?” moments and more time executing a plan. Security isn’t overhead — it’s what lets you scale without fear.

What Bad Security Costs 🤦

One weak link, total damage.

Reuse a password or skip 2FA and a single breach can open every account you own.

Hot-only = high risk.

Keeping your whole stack in a hot wallet or on an exchange is convenient — until a hack, SIM swap, or malware drains it.

Keys shared = coins gone.

Private keys/seed phrases are ownership. Share them once and recovery is basically zero.

Scams are social, not just technical.

Fake support, influencer DMs, slick phishing pages — one rushed click can erase months of gains.

No undo button.

Crypto is final settlement. Without insurance or platform safeguards, losses are permanent.

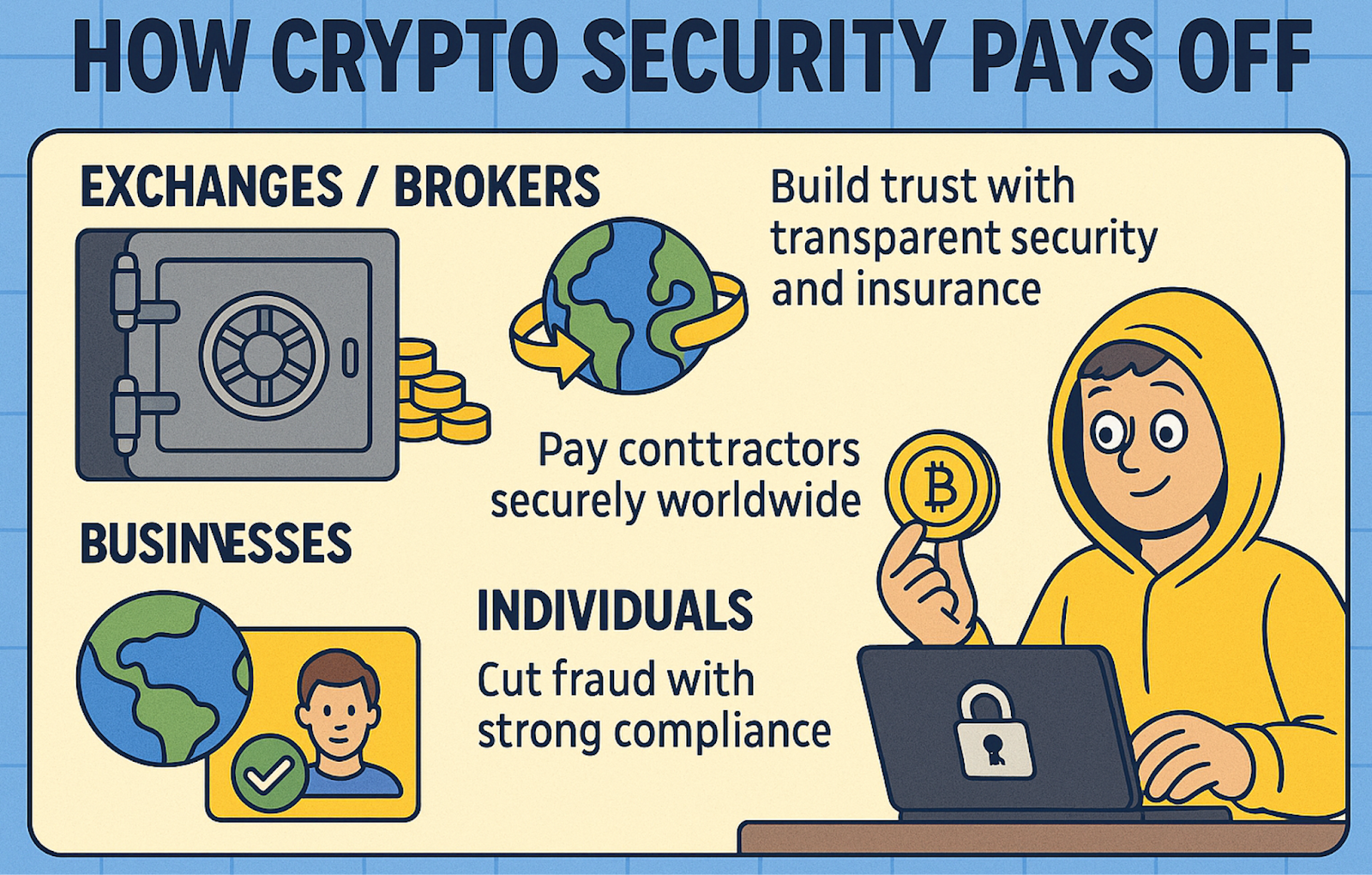

How Security Pays Off

Security in crypto isn’t just about staying safe — it’s about unlocking real opportunities.“There’s also plenty of people who have lost huge amounts of crypto to loss rather than theft.” — Vitalik Buterin

Exchanges and brokers that prove they’re secure win trust fast. People stick with platforms that show transparency, keep most funds in cold storage, and even offer insurance if something goes wrong.

Businesses can pay teams around the world instantly. With secure wallets and reliable exchanges, payments land in minutes — no banks, no delays.

Payment apps that follow strong rules like KYC and AML aren’t boring — they’re the ones people trust. Fewer scams, smoother transactions, and way more confidence for users.

For you as an individual, security = freedom. Strong passwords, 2FA, and a cold wallet mean your crypto is yours alone. No scammers, no stress.

And with GoMining, security is built in. You get daily Bitcoin rewards without dealing with sketchy mining rigs or risky platforms. It’s learning, earning, and growing — all with the peace of mind that your assets are protected.

Conclusion — Lock It In 🔒

Crypto’s upside is huge, but only if your security is tighter than your entries. Treat 2FA, strong unique passwords, and a hot/cold wallet setup as non-negotiable. Trade on transparent, regulated platforms, double-check every link, and remember: your keys = your coins.

Hacks, phishing, malware, and social engineering don’t care how experienced you are. One slip can zero you out, and there’s no undo button on-chain. Build the habit stack now so you can focus on growing — not recovering.

TL;DR: Secure first, trade second. Protect your keys, verify everything, and let your security do the heavy lifting while your portfolio compounds.

Frequently Asked Questions (FAQ)

Q: Why is security more important in crypto than in banking?

A: Because in crypto, you hold the keys. If compromised, there’s no central authority to recover your funds.

Q: What’s the safest way to store crypto?

A: Cold storage wallets like Ledger or Trezor — offline, hack-resistant, and ideal for large holdings.

Q: Are all exchanges safe?

A: No. Even major platforms can be hacked. Choose those with strong audits, insurance, and cold storage.

Q: How do I avoid scams?

A: Never share private keys, beware of phishing sites, and treat “guaranteed profit” promises as red flags.

Q: Does regulation improve security?

A: Yes. KYC/AML measures and platform audits reduce fraud, protect traders, and build safer markets.

October 21, 2025