In simple terms, pool hopping is a miner’s attempt to “game the system” by switching between pools exactly at the moments when their shares are worth the most.

It’s like visiting a buffet only when the staff brings out the fresh hot dishes and leaving the moment everyone else grabs the best food. Technically, you didn’t break any rules — you just came and went. But everyone understands it’s unfair.

For a long time, this strategy actually worked in crypto mining — especially with early pools using proportional payout models (PROP), where your reward depended on when exactly you submitted your shares.

Modern pools changed their payout logic, added anti-hopping protections, hide when each round starts, and use behavioral analysis. As a result, pool hopping has almost completely died out — now it’s more of a historical chapter than a real way to earn extra income.

To understand why this strategy appeared, how it worked, and why it disappeared, we need to look at how pools function. That’s where the interesting part begins.

What are Crypto Mining Pools and how they pay

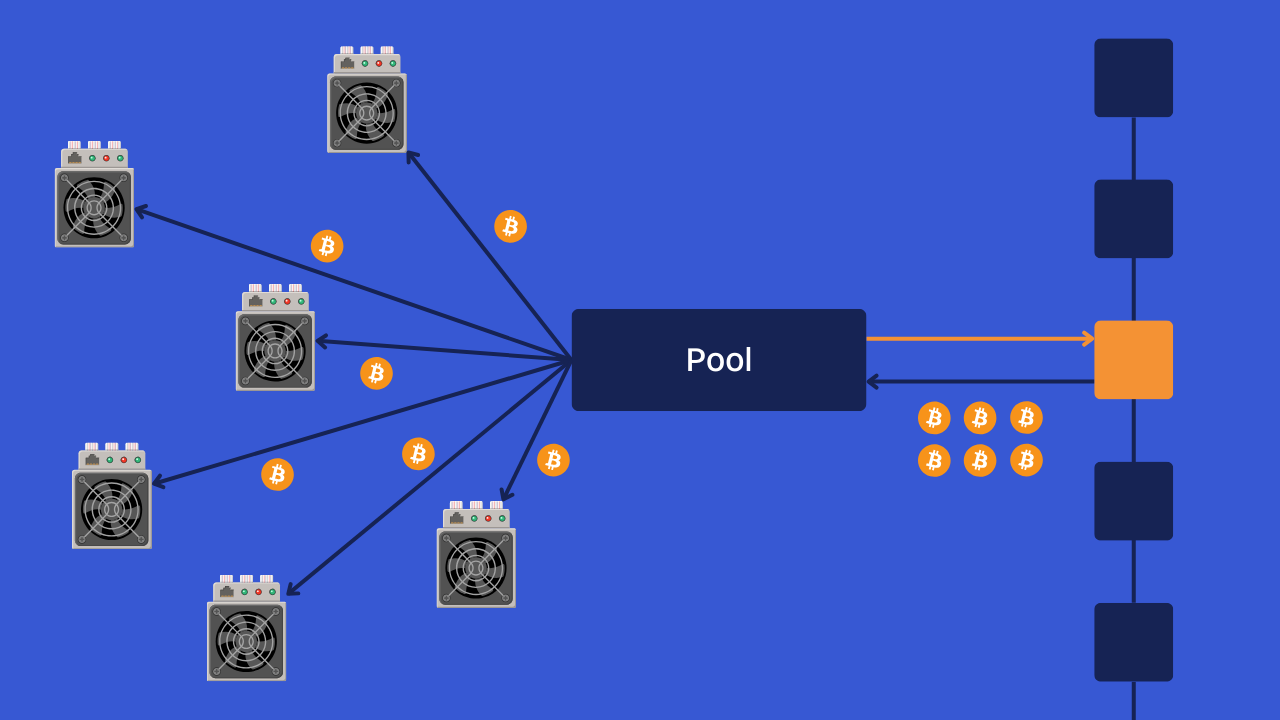

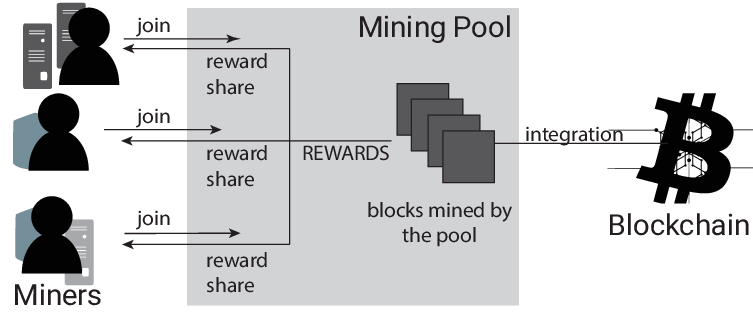

When people first hear “mining pool,” they often imagine a big server that distributes tasks among miners. In reality, it’s simpler: a pool is a service that aggregates participants’ hashrate and helps them find blocks faster.

How a Mining Pool Works

This brings us to the key question: How do you fairly divide the reward among thousands of miners?

The answer lies in a concept called a share.

What Shares Are and Why They Matter in Crypto Mining

When you mine inside a pool, you aren’t waiting for your machine to find a block — that could take ages. The pool instead asks you to perform partial tasks called shares.

A share is proof that you actually did computational work. Your miner searched through many hashes and found one meeting the pool’s simplified difficulty target.

A share is not a full block solution. It does not earn the block reward directly from the network. Instead, it’s a kind of “work receipt.” The pool collects all shares from participants and then distributes the block reward proportionally once a real block is found.

What are shares in mining?

Why Shares Matter. The more shares you submit, the larger your share of the total work. This makes the system fair — you earn proportionally to your contribution, without gambling on whether your machine finds a block.

Mining solo can produce bigger payouts, but they’re extremely rare. Pools trade rarity for predictability and stable income.

Imagine you and some friends are digging in a mine. Finding a gold nugget (a block) is very rare. Instead, everyone brings buckets of dirt every day — and when someone eventually finds a nugget, the reward is split based on how many buckets each person carried.

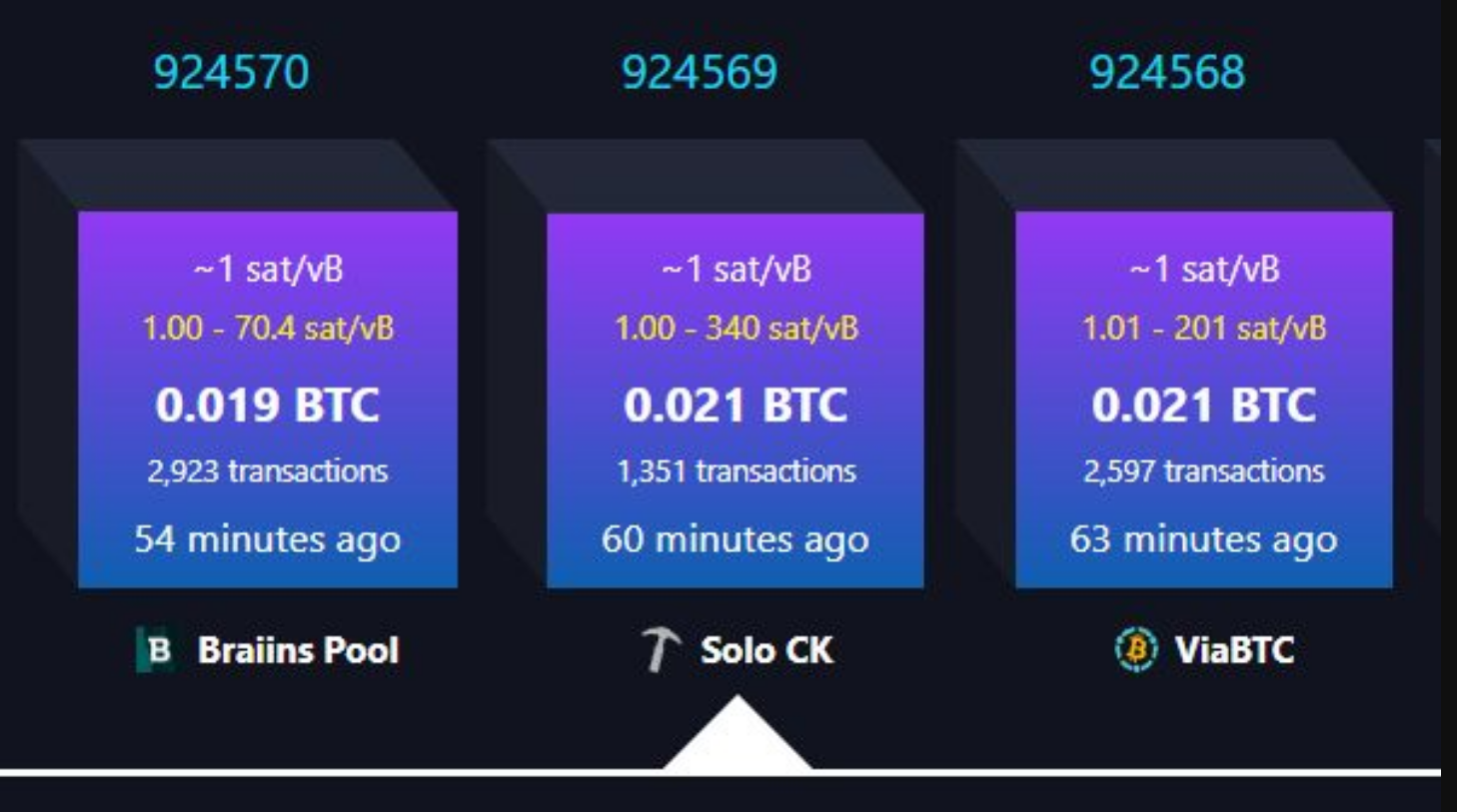

Solo miners can find blocks occasionally. For example, on November 21, a solo miner found a block and earned 3.146 BTC ($264 000).

Source: mempool.space

But that’s essentially a lottery win — extremely rare.

Pool work happens in cycles called rounds:

- A new round starts;

- Miners submit shares as proof of work;

- The pool eventually finds a block;

- The reward is distributed.

If the payout model depends on the current round — like PROP — miners can manipulate timing: joining when the round is fresh and rewards are high, and leaving when shares get “cheap.”

This timing trick lies at the core of pool hopping.

Pool Hopping — Subtle, but Tricky Strategy

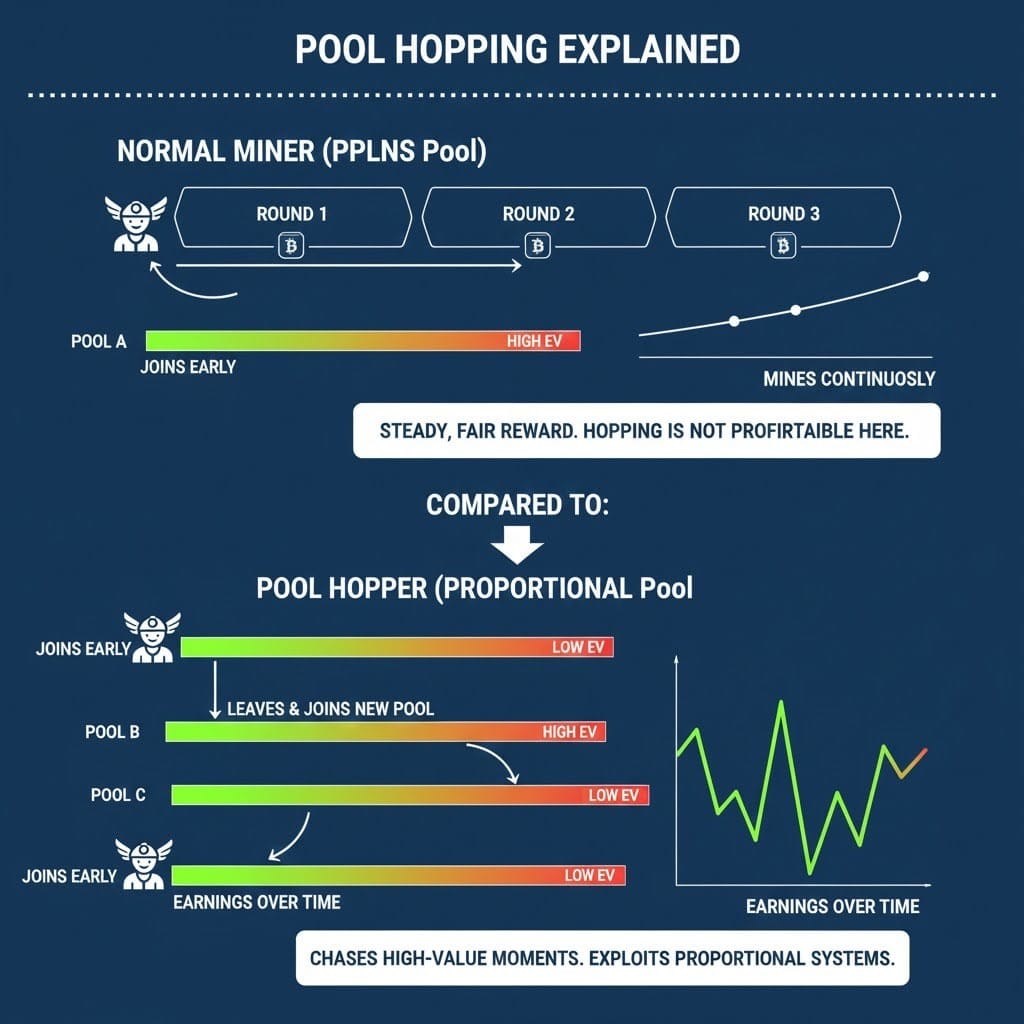

A pool hopper does not mine steadily. Instead, they “jump” into a pool only when their shares have elevated value. They:

- join at the start of a round, when shares are most profitablemine as long as EV (expected value) stays high

- disconnect as soon as the round drags on

- switch to another pool and repeat

They skim the cream, while honest miners carry the load continuously.

Imagine a workplace where pay is proportional to tasks completed each day. You show up early, when there are few tasks and each one is highly valued. Once the backlog grows and your effort becomes less impactful, you leave for another team where the day just started.

You end up making the most with minimal effort, while steady workers earn far less than they should. That’s exactly how pool hopping exploited old payout models.

Why Pool Hopping Worked in the First Place for Crypto Mining

To understand why this scheme generated profit, think of each share having a “price” — its expected value (EV). In older PROP pools, EV was not constant:

- early shares were much more valuable

- late shares were significantly cheaper

If the round ended quickly (e.g., a block found in 1 minute):

- only a few shares were submitted

- each early share earned a huge portion of the reward

If the round dragged on:

- many shares accumulated

- each individual share earned very little

Hoppers simply joined early, harvested high-EV shares, and left when the round became long and unprofitable. Math-wise:

- in a short round, they divide reward R by a small number of shares S₁

- honest miners divide it by a much larger number S₂

Since S₁ < S₂, the hopper’s EV is higher for the same amount of work.

That’s where their unfair advantage came from.

How does pool hopping work

Which Crypto Mining Payout Models Are Vulnerable to Pool Hopping — and Why

When mining first became widespread, pools used the PROP payout model because it was simple and looked fair: everyone received a portion of the reward proportional to the number of shares they submitted during the current round.

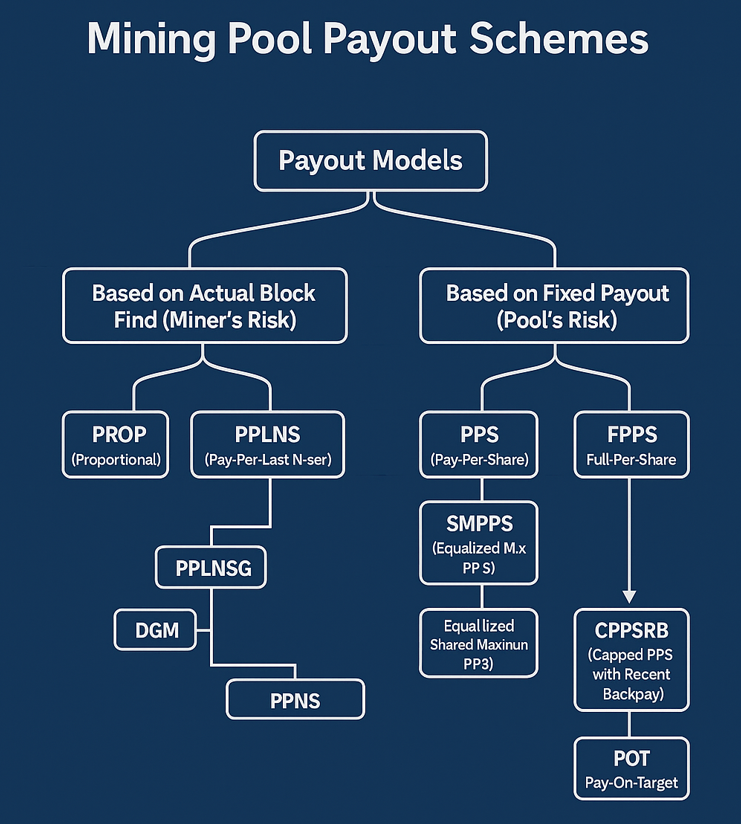

Main types of payout models

PROP was the first payout system understood both by miners and the earliest pool operators — no complicated formulas, no payout queues. Logic was straightforward: pool finds a block, gathers all submitted shares, calculates each miner’s contribution, and distributes the reward.

On paper it seemed perfect, but PROP was vulnerable to exactly one small thing that would later be called pool hopping.

The issue was that the value of a share in PROP was not constant — early shares were worth more, and shares submitted later were worth less. If the pool found a block quickly, the round was short, few shares were submitted, and each early share represented a massive portion of the reward. If the round lasted long, many shares accumulated, and the value of each individual share dropped sharply.

This created the temptation to enter the pool only at the start of the round, when shares were “expensive,” stay for just a couple of minutes, and then leave for another pool as soon as the round began to stretch out.

What looked like a harmless trick actually produced an extra 20–40% profit, which was confirmed across multiple Bitcointalk studies and simulations from 2012 to 2014. Some miners called it “profit optimization,” while others saw it as parasitic behavior that punished honest participants who stayed in the pool throughout the entire round.

Source: bitcointalk.org

To close the PROP loophole, pools began experimenting: models like SMPPS, ESMPPS, and other queue-based hybrids appeared, trying to equalize rewards and mitigate the unfairness.

However, these models still couldn’t fully eliminate the problem — hoppers could still target certain payout queue states and extract extra value when the pool underpaid or when the backlog created exploitable conditions.

It wasn’t until the PPLNS model arrived that the situation fundamentally changed. Its idea was simple: remove the dependence on “round age” entirely and measure the miner’s contribution based on the last N valid shares, regardless of timing. This meant you could no longer just jump into a pool at the start and extract high-value rewards — what mattered was not when you joined, but how many shares you contributed within the last N.

Modern enhanced versions of PPLNS (PPLNS+, PPLNSG, etc.) polished this logic even further: timing your entry is no longer an advantage.

As a result, PROP gradually became obsolete — almost no major pool uses it today except for small experimental projects. The entire industry moved toward payout structures resistant to manipulation.

Crypto Mining Payout Models Resistant to Pool Hopping

When pools faced widespread hopping exploitation in 2011–2013, they had to develop payout systems that couldn’t be gamed by timing alone. This sparked the evolution of a new generation of robust, manipulation-proof payout models. Below are the key ones.

PPS — Absolute Protection Against Hopping (≈ 2011, introduced by Meni Rosenfeld). PPS (Pay-Per-Share) was proposed by early mining researchers as a method to eliminate dependence on round length entirely. The idea:

- the pool pays a fixed amount for every valid share

- regardless of whether the pool finds a block or not

Participation becomes like a fixed salary: If you work — you get paid. If you don’t — you don’t.

Because rewards are completely independent of round timing — no early shares, no late shares, no varying EV — there is nothing to exploit.

Modern PPLNS — the Gold Standard of Anti-Hopping (≈ 2012, refined by many pools). PPLNS (Pay-Per-Last-N-Shares) emerged as a direct response to PROP abuse. The key difference: It counts not all shares in the current round, but only the last N shares before a block is found. Pools usually hide both the size of the N window and when it starts, so:

- you don’t know when the window begins

- you don’t know when it ends

- you don’t know whether your shares will fall inside it

The unpredictability makes timing useless. Hopping turns into a lottery with negative expected value. By 2014–2015, PPLNS became the industry standard for fair distribution.

FPPS / FPPS+ — Full Protection + Fee Sharing (≈ 2014–2016). FPPS (Full Pay-Per-Share) expands on PPS:

- it pays the guaranteed PPS reward

- AND distributes all transaction fees (or most, in FPPS+)

Since the reward structure is completely unlinked from round duration or timing — and the pool absorbs all statistical risk — FPPS is considered the final nail in the coffin of pool hopping.

Once large pools migrated to FPPS and advanced PPLNS variants, hopping effectively died as a strategy.

Why Pool Hopping Harms Honest Miners

Pool hopping isn’t just “not nice”, It fundamentally breaks the logic of fair reward distribution. Hoppers strategically enter only during the profitable phase and take more than their fair share, while honest miners who stay throughout the entire round end up subsidizing them.

Hoppers Pull Rewards Out of Thin Air

They enter exactly when the chance of a quick block is highest, submit a small number of high-value shares, and leave. Their extra profit comes not from doing more work, but from gaming the timing. Honest miners, who dilute the total share count over long rounds, end up losing income they rightfully earned.

Honest Miners Lose Up to 40% of Income

Old Bitcointalk research and simulations (2010–2015) showed that mass hopping reduced reward for honest miners by 20% to 40%. If the pool pays jumpers for ten minutes of “smart timing” while you mine for a full day — the math of the pool reward system collapses.

Pools Become Unstable

Hopping makes hashrate spike unpredictably. Rounds become longer, variance grows, and the pool’s block-finding probability worsens. Even if algorithms stay unchanged, chaotic miner behavior undermines the pool’s efficiency.

The Network Becomes Less Predictable

Pool Hopping can actually be weaponized to fight competition. There were cases where hopping was used to pressure competing pools — destabilizing their hashrate and reducing their performance. This created tension across the early mining ecosystem and damaged trust.

How Modern Crypto Mining Pools Prevent Pool Hopping

The industry learned its lessons: modern pools are engineered so that hopping has neither mathematical nor practical value.

They Deploy AI Analysis. Large European and Asian pools use machine-learning systems to analyze anomalies across dozens of metrics — essentially full anti-fraud systems for mining.

They Use Behavioral Analytics. Hashrate spikes, synchronized switching, unnatural patterns — all of this is detected instantly.

They Penalize Frequent Reconnects. Pools track suspicious behavior: quick joins and leaves, attempts to catch short rounds, constant switching. Such miners may have their priority reduced — or be outright banned.

They Increase the N Window Size. A larger PPLNS window makes manipulation impossible — even if you “guess right,” your contribution is diluted over thousands of recent shares.

They Hide Round Start Times. If you don’t know when a round begins, you cannot detect when shares are expensive.

Is Pool Hopping Still Relevant in Crypto Mining as of 2025?

Short answer: no.

Long answer:

- on modern payout schemes like PPLNS, PPS, and FPPS, hopping gives zero advantage

- pools hide all timing-sensitive data

- the strategy is economically meaningless — a hopper’s EV is now lower than an honest miner’s

- attempts to hop usually result in an instant ban

Today, pool hopping is a historical artifact. It once worked, but now it’s as relevant as VHS tapes — a relic of a bygone era.

Should a Beginner Try Pool Hopping in Crypto Mining?

Absolutely not. Not only will you not earn more, but:

- you’ll waste time on monitoring and switching

- you’ll earn less than with stable mining

- you risk being banned

- you are competing not with people but with bots switching in milliseconds

If your goal is to maximize income, use predictable, math-based tools like the official GoMining calculator:

👉 https://gomining.com/calculator

It shows the real expected value of hardware — not the illusions of quick-profit strategies.

Pool Hopping in Crypto Mining Is Dead — But Understanding It Still Matters

The story of pool hopping is an example of how the mining industry learns and evolves. Early pools were naive and vulnerable, but over time payout models became more transparent, fair, and resistant to manipulation. Understanding pool hopping helps you:

- better grasp the economics of mining poolsrecognize which payout models are fair and which are questionable

- spot potential manipulation patterns

- choose proper strategies and avoid traps

If you want to strengthen your fundamentals in mining, check out:

- Big Crypto Mining Guide for 2026: https://gomining.com/blog/the-complete-guide-to-cryptocurrency-mining-in-2026-from-theory-to-practice

- Why You Should Keep Some Assets in Crypto: https://gomining.com/blog/why-you-should-keep-some-of-your-assets-in-cryptocurrency

Summary for the Pool Hopping in Crypto Mining

The history of pool hopping shows how quickly the mining industry has matured. A once lucrative loophole exploit strategy that gave certain miners an unfair advantage and undermined trust within pools has been completely neutralized by the evolution of payout models and modern anti-manipulation mechanisms.

Today, mining is far more transparent and fair: rewards are tied to actual contribution, and advanced algorithms together with anti-fraud systems protect honest participants from any attempts to “game” the process.

Understanding how pool hopping worked — and why it eventually disappeared — helps miners better grasp pool economics and appreciate why modern payout structures are designed the way they are: to ensure stability, predictability, and fairness for everyone involved.

Sign up and get access to free (for now) GoMining course on crypto and Bitcoin mining.

Telegram | Discord | Twitter (X) | Medium | Instagram

FAQ

1. Is pool hopping considered fraud?

No, it's not illegal — but nearly all pools consider it dishonest behavior and ban it.

2. Can a hopper really earn more today?

No. On PROP — yes, but there are almost no PROP pools left.

3. Why is PROP the most vulnerable model?

Because the reward depends on round length, and early shares are worth more.

4. Does hopping work on GPUs?

Hardware doesn’t matter — only the payout model matters.

5. Can you detect the start of a round?

Modern crypto mining pools hide this information.

6. Can you hop using multipool bots?

You can, but there’s no point. You won’t earn anything extra.

7. Is hopping forbidden?

Yes, in most major pools.

8. Why are early shares “more expensive”?

Because if the round ends quickly, your early shares take a disproportionately large share of the reward.

9. How much extra could you earn back then?

About 20–40% during the Bitcoin pool era of 2010–2015.

10. Why study pool hopping if it’s dead?

Because it shows how payout models evolved and helps you see weak points in reward systems.

11. Does hopping still work anywhere?

Only on tiny experimental PROP pools — and even there, profit is minimal.

12. What’s the best mindset for a new miner?

Focus on stable mining and proper reward models, not timing tricks from a decade ago.

December 2, 2025