Bitcoin is up today largely because the market is attempting to stabilize after a liquidation-heavy period. Short covering and dip buyers can lift BTC quickly once forced selling slows — but durability still depends on spot-led demand and improving liquidity.

Key Takeaways

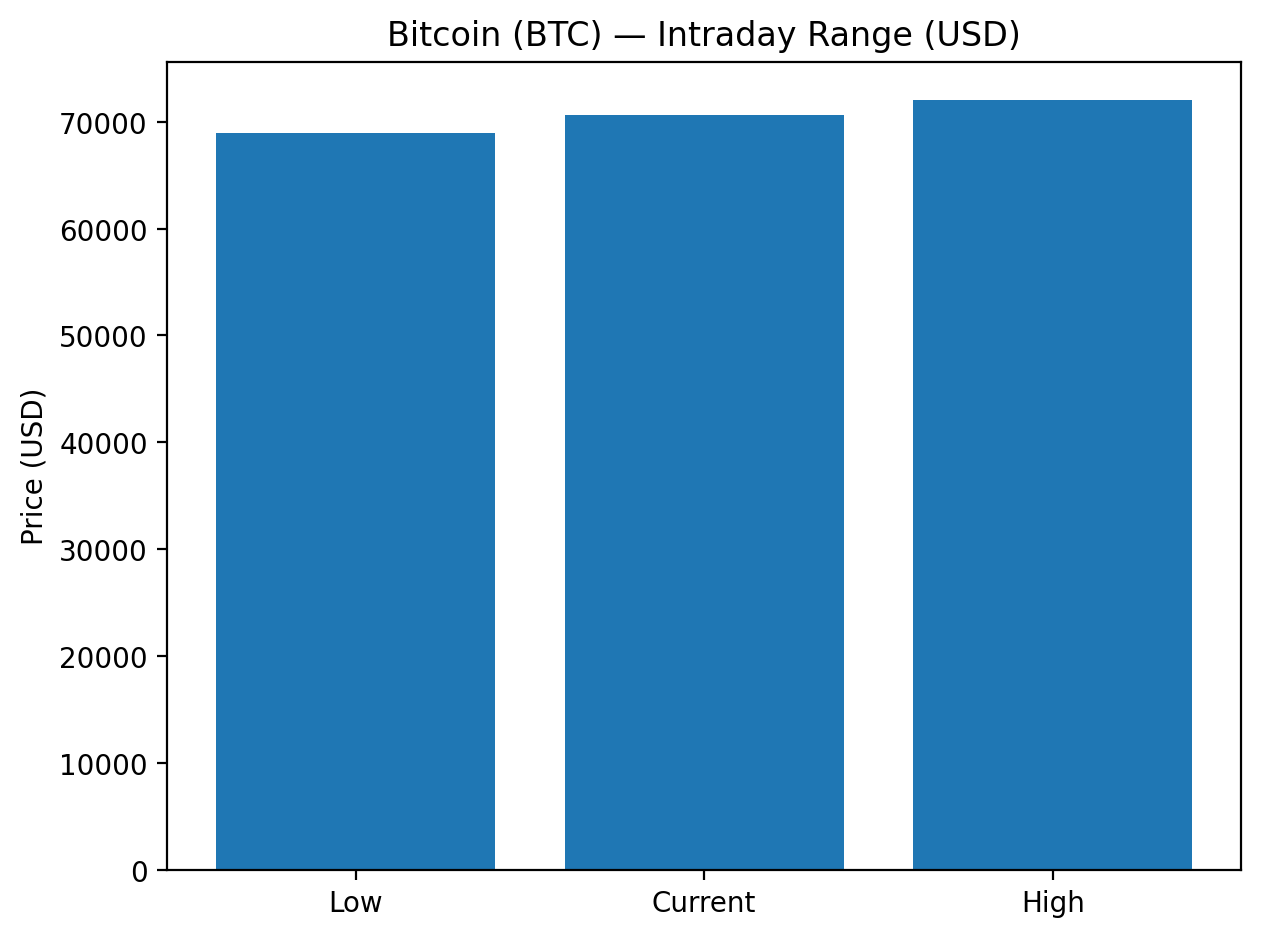

BTC is up about 2.01% today near $70,627 after swinging between roughly $68,966 and $72,024. (Tool price snapshot)

Liquidation mechanics can create overshoots and fast rebounds when market makers can’t fully absorb flow. (Cointelegraph)

ETF outflows can reduce the “steady bid” that typically supports sustained rallies. (Cointelegraph)

Even with a green day, analysts warn narratives can be fragile without a new catalyst. (Investopedia)

Bitcoin intraday range (original visual). Data: tool price snapshot.

ETF flow context (original visual). Outflow totals reported by Cointelegraph.

A quick snapshot of Bitcoin today

Bitcoin is trading higher on Feb 9, 2026, up roughly 2.01% at about $70,627. The session’s intraday band ($68,966 to $72,024) is wide, which is typical when markets are still digesting a prior volatility shock.

A positive day does not automatically mean “macro is solved.” Often it just means the market has found a temporary balance between sellers and a new wave of buyers.

The mechanical reason: forced selling slows

When prices fall quickly, leveraged positions get liquidated; when that wave slows, the market can rebound sharply. Cointelegraph highlighted how liquidation engines can continue firing even when liquidity is stressed, increasing the odds of exaggerated downside moves that later mean‑revert.

Haseeb Qureshi (Dragonfly) summarized stressed conditions: liquidations “could not get filled, but liquidation engines keep firing regardless,” and he added that market makers “will need time to recover.” That dynamic helps explain why BTC can bounce even while sentiment is still cautious.

The “confidence” reason: dip buyers step in

After abrupt selloffs, sentiment can overshoot. Once sellers are exhausted, dip buyers test the waters — especially if Bitcoin holds a psychologically important zone.

But the rebound still needs proof of demand. Investopedia quoted Jim Bianco warning that “Winter continues until a new narrative emerges,” underscoring why traders want confirmation.

What would make the up move more durable?

Look for (1) multi‑day stability above reclaimed levels, (2) improving spot market depth (tighter spreads), and (3) less aggressive near‑dated protection demand in options. If those conditions appear, the rebound is more likely to persist; if they don’t, BTC can slide back into its prior range quickly.

Sources

Cointelegraph — Spot Bitcoin ETF outflows total $2.9B as BTC price drops to new 2026 low (Haseeb Qureshi quote): https://cointelegraph.com/news/spot-bitcoin-etf-outflows-total-2-9b-as-btc-price-drops-to-new-2026-low

Investopedia — Bitcoin’s Price Drops Below $67,000. Welcome to 2026’s ‘Crypto Winter’ (Jim Bianco quotes): https://www.investopedia.com/bitcoin-s-price-drops-below-usd67-000-welcome-to-2026-s-crypto-winter-mstr-11900072

Tool price snapshot — BTC used for intraday range and % change.

February 9, 2026