Market Analysis with Mike Ermolaev

This week in the cryptocurrency market has been a testament to Bitcoin's enduring allure and volatility. Despite geopolitical upheavals and significant market retracements taking place in the lead-up to the Bitcoin halving event, the cryptocurrency landscape still remains vibrant and ever-evolving. Mike Ermolaev, a seasoned crypto journalist and analyst who oversees CryptoDaily's editorial team, is again cutting through the industry noise to bring GoMining community members front-row updates on the current market environment.

This past week, Bitcoin's ride was a rollercoaster with its value swinging from $60,181 to $71,120 – just another episode of volatility in the world of digital currency where global economic twists and market sentiment play huge roles.

Bitcoin's Price Fluctuations and Geopolitical Influences

A number of factors contributed to the drop in the BTC value. As soon as news broke about the increased tensions between Iran and Israel, fear of risk mixed with all that unpredictability weighed prices down. There have been indications that investors were stepping back from Bitcoin to find investments that feel a bit more like solid ground.

According to some experts, the prices were swift to react to recent geopolitical tensions between Iran and Israel, driven by uncertainty and risk aversion across the board. This has impacted cryptocurrencies, including Bitcoin, as investors navigate the heightened volatility and seek safer investment havens.

Market Retracement and Long-Term Holder Activity Preceding Bitcoin's Halving

However, in line with historical patterns observed before Bitcoin's halving events, the market typically experiences a retracement. This period reflects the market's bracing for miner rewards to shrink, which means supply would tighten and prices would rise in the near future. We can think of this downturn as a healthy correction or the market taking a quick breather before gaining ground again.

Echoing this view, analysts from Bitfinex noted a similar trend to the "2020 pattern" which is characterized by a significant reduction in inactive Bitcoin supply. This movement, not seen for over a year, often precedes a sharp price increase and indicates active trading or off-exchange movements by long-term holders.

According to the report, long-term holders (LTHs) who have owned their bitcoins for more than 155 days started to actively sell off their coins at a rate of about 16,800 BTC daily. Based on previous cycles, we can expect this trend to last about seven months and the peak for this cycle may be six months away. The important thing to keep in mind is that this cycle is unlike any other, with prices being more “compressed” – up faster than previously, with BTC reaching an ATH prior to the halving.

Source: LookIntoBitcoin

Among other potential reasons behind this week’s drawdown could be liquidations of futures positions. Recent data from Coinglass highlights that over $93.40 million in long Bitcoin futures were liquidated in a single day. Such liquidation moments play a huge part in making Bitcoin's prices swing sharply and sometimes plummet.

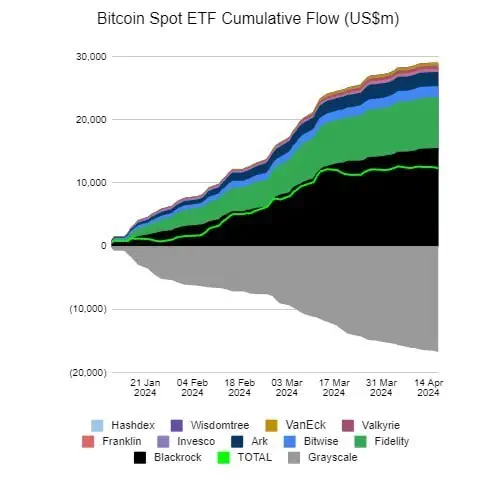

Bitcoin ETFs Show Mixed Trends Amid Fluctuating Investment Patterns

Meanwhile, the landscape of Bitcoin ETFs has shown mixed signals. According to Farside Investors data, the past week saw divergent trends across several funds. BlackRock’s iShares Bitcoin ETF (IBIT) led with substantial inflows totaling approximately $402.4 million. In contrast, the Fidelity Wise Origin Bitcoin Fund (FBTC) reported modest inflows of $6 million, and Bitwise’s BITB saw $11.1 million. Meanwhile, ARK Invest’s ARKB experienced an outflow of $12.9 million, indicating some investor retreat. Smaller inflows were noted in Franklin Templeton’s EZBC and Valkyrie’s BRRR, which attracted $1.8 million and $1.7 million, respectively. VanEck's HODL also saw inflows, adding $3.6 million. Notably, Fidelity’s BTCW and Invesco Galaxy’s BTCO reported no changes in their holdings. On the other end of the spectrum, Grayscale’s Bitcoin Trust (GBTC) faced a substantial outflow of approximately $613.7 million.

Source: Farside Investors

An interesting opinion was expressed by Bloomberg Intelligence analyst Eric Balchunas, who suggested that BlackRock might surpass Grayscale in terms of held Bitcoin volume before the end of the month, marking a significant shift in institutional investment patterns.

Hong Kong Sets Precedent with Approval of Ether ETFs

Following up on the topic of crypto ETFs, in a significant regulatory shift, Hong Kong regulators approved the launch of spot bitcoin and ether exchange-traded funds (ETFs) on Monday. The introduction of these ETFs in Hong Kong is particularly noteworthy as it includes not only bitcoin but also ether, setting a precedent as one of the first jurisdictions globally to sanction an ether ETF.

US Senate Tightens Stablecoin Regulations with Updated Lummis-Gillibrand Act

Meanwhile, the US Senate has updated its bill on stablecoins, aiming to impose stricter regulations, specifically for algorithmic versions. The Lummis-Gillibrand Payment Stablecoin Act requires that all stablecoins be backed by the same amount of cash or something just as valuable, and it forbids stablecoins that don't have this backing. It covers both federal and state levels of oversight, keeping the U.S. banking system's structure intact, and includes steps to protect consumers. For example, if a stablecoin company goes bankrupt, there are specific rules on how to handle it under this bill.

Pavel Durov on Secure Communication and Privacy in the Age of Surveillance

During an interview with Tucker Carlson, Pavel Durov, the founder of Telegram Messenger, voiced his concerns about the growing eyes of government surveillance infringing on our privacy rights. In response to these growing intrusions, he's predicting we'll soon see the rise of secure communication devices that work like cryptocurrency wallets, all to keep our chats private and out of the government surveillance.

Durov brought up the UAE as the top choice land for any entrepreneur looking to safeguard privacy because of its no-sides approach in politics. "It’s a small country that wants to be friends with everybody. It’s not aligned geopolitically with any of the big superpowers. And I think it’s the best place for a neutral platform like ours to be in if we want to make sure we can defend our users’ privacy and freedom of speech," Durov explained.

Conclusion

This week in the cryptocurrency market has been one of remarkable turbulence and resilience, as described by Mike Ermolaev in the latest edition of GoMarket Weekly. Amid geopolitical tensions and the anticipated Bitcoin halving, the market's dynamics have been anything but static, highlighting Bitcoin's notorious volatility, which had seemed to fade recently, but flared up again. However, as we watch the market adapting to everything from Bitcoin ETFs shaking up the scene to new rules in play, it's crystal clear that the cryptocurrency market will endure and thrive this time as well. With the landscape of crypto shifting under our feet, being quick to adapt and always in the know can make all the difference.

Disclaimer: Please remember, the information discussed here isn't meant to be taken as investment advice. Conduct your own research and consult with financial advisors before making any investment decisions

April 19, 2024