To understand backwardation, let's first take a quick look at futures.

There are two prices on the market:

1. Spot is the usual price of the commodity or asset itself. For example, $3 per kilogram of tomatoes.

2. Futures — the price at which it is agreed to buy or sell a commodity in the future. That is, you enter into a contract today, and the settlement takes place later.

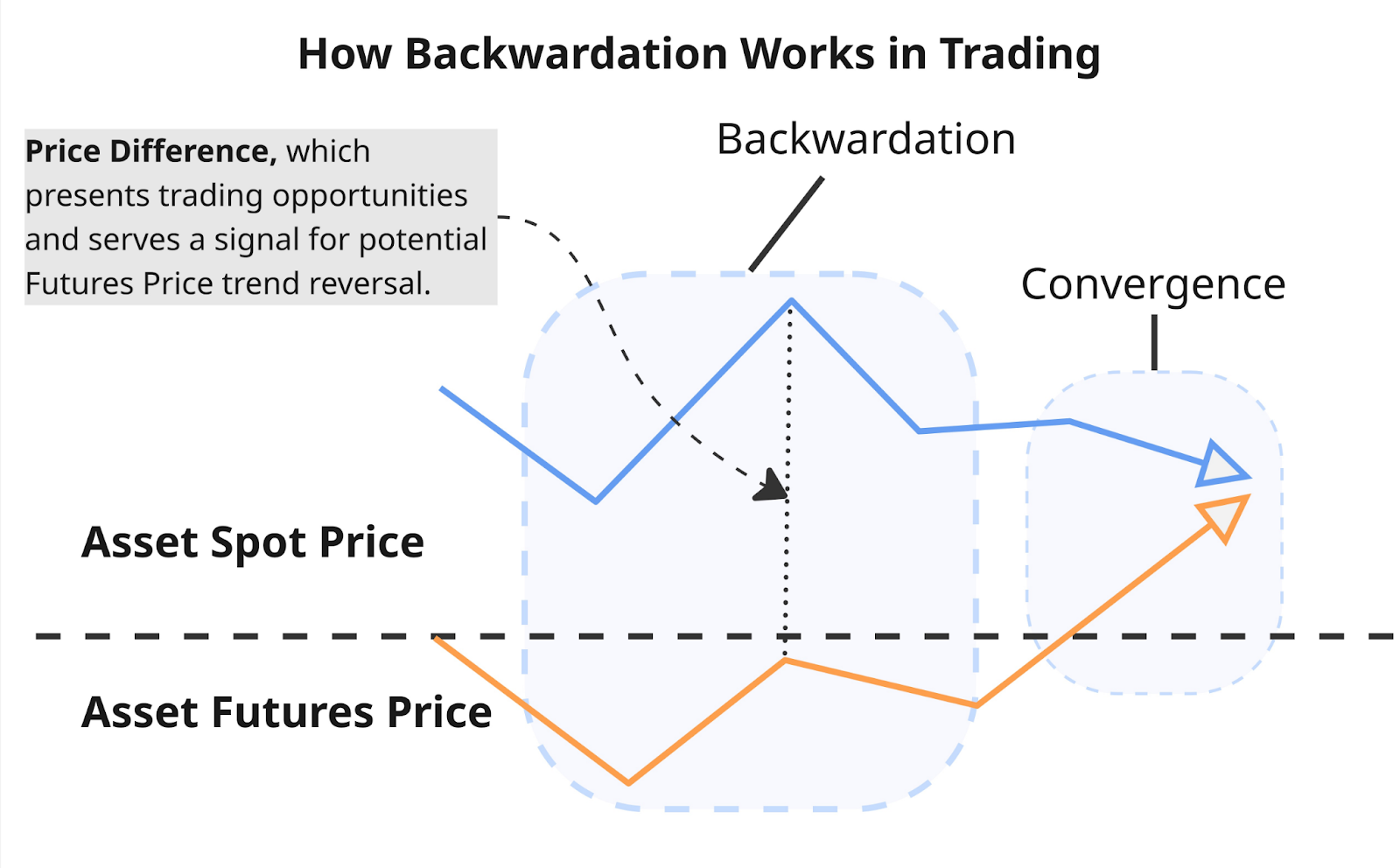

Backwardation is when the spot price is higher than the futures price.

Simply put, this is what happens:

1. The price of the asset itself is higher than the futures price.

2. Those who bought futures and then received the asset are in the black.

3. Long positions on futures take leverage, putting a little pressure on the spot market.

4. After a while, the futures and spot prices even out and stabilize.

In other words, backwardation is a temporary difference between the price of an asset today and the price of a futures contract, which provides opportunities for both hedging and speculation.

Source: GoMining.com

The role of backwardation in futures contracts

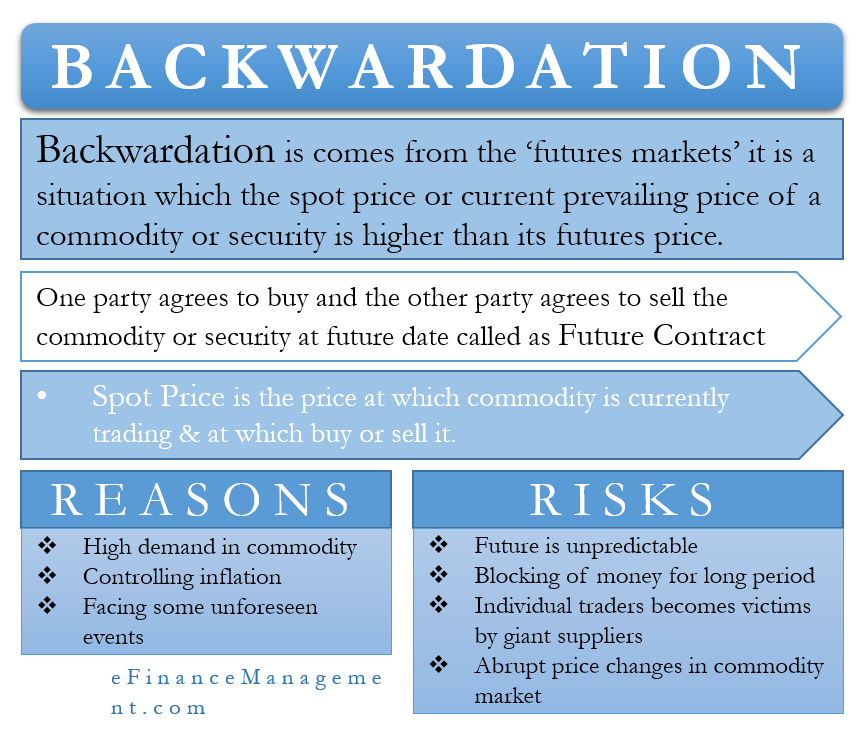

Backwardation is when futures are cheaper than the expected spot price at the time of execution. This affects the strategies of different market participants.

For producers and suppliers, it is a way to protect themselves from falling prices. By entering into a contract during a period of backwardation, they fix the price of future deliveries in advance. If the market falls later, the contract they have already signed protects them from losses. This is especially important in sectors with unpredictable factors, such as agriculture, where harvests depend on the weather and can vary greatly from season to season.

Speculators see backwardation as an opportunity to make money. They buy futures at the current price and wait for the price to rise to the spot level by the time of execution. If this happens, the difference between the prices becomes their profit.

In other words, backwardation is two sides of the same coin: for producers and suppliers, it is protection against price spikes, and for speculators, it is an opportunity to make money.

Source: Efinancemanagement.com

Rules to avoid losses in backwardation

Interaction with backwardation focuses on strategies to minimize losses rather than on seeking returns. Market operators must not only analyze current quotes, but also predict how prices will converge as the expiration date approaches in order to avoid forced position closures.

1. Restraint in Long Positions. A futures contract traded at a discount may seem attractive. However, if the market does not correct (or goes down), this discount translates into financial costs. This tactic is not reliable without clear signs of sustained growth in the underlying asset.

2. Special Risks of Short Positions. If futures are trading below the spot price and the overall trend is downward, this may indicate a decline in demand. However, when holding short positions, the effect of price convergence cannot be ignored: futures will tend to converge with the spot price, which increases the risk of forced liquidation of the short position. The use of strict protective orders (stop losses) is essential.

3. Exclusion of Complex Arbitrage Schemes. Attempts to use the price gap for “safe” trades require flawless execution and minimal transaction costs. In the crypto market, miscalculated arbitrage operations almost always lead to instant financial failure.

4. Priority to Hedging. If a participant already owns an asset, backwardation provides an opportunity to fix its estimated value by selling a futures contract, thereby protecting against a fall in the spot price.

Factors leading to backwardation

Backwardation occurs when the current price (spot) of an asset becomes higher than the futures price for the same asset.

Why this happens:

1. Increased demand or shortage of goods. People want to get the goods right now, rather than wait for future delivery. For example, if there is little coffee on the market, buyers are willing to pay more to get it immediately.

2. Problems with supply or logistics. Interruptions in production, delivery, or rising transportation costs make current goods more expensive.

3. Storage factors. If it will be cheaper to store goods in the future, participants may not buy contracts for future delivery and instead focus on the current market.

In simple terms, backwardation occurs when goods are more valuable now than they will be in the future, and immediate access to them becomes more important than purchasing future delivery.

How to make money on backwardation

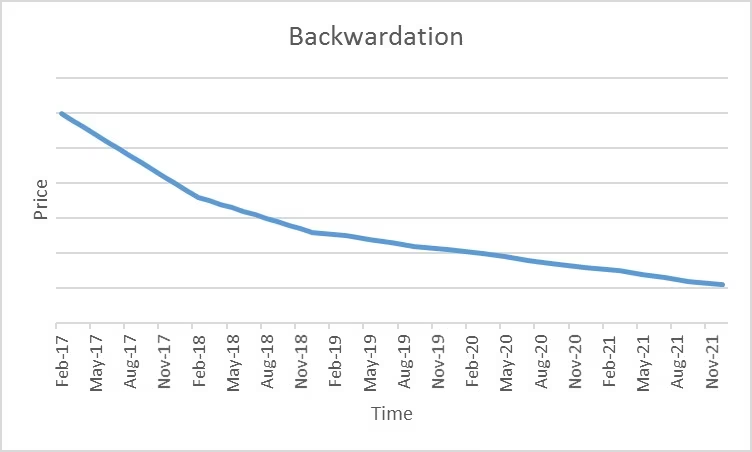

When working with backwardation, you need to understand how prices change when the balance of supply and demand shifts and why futures sometimes cost less than the spot price. You should take into account current quotes and the expected market reaction as the expiration date approaches.

One approach is to buy a futures contract when it is cheaper than the expected future value of the asset. If the market closes the gap between the futures and spot prices, the difference turns into a profit. This strategy only works when the price of the underlying asset is rising or when the price gap is narrowing.

Backwardation is when the spot price is higher than the futures price. It seems like an easy way to make money, but without caution, you can lose money.

1. Analyze the market, not just prices. If the asset is falling, a long position can result in a loss, even if the futures price seems favorable.

2. Don't focus solely on the price difference. Futures may be cheaper than spot, but the difference does not always quickly even out and may change to your disadvantage. Don't open a trade just because of the price — assess the whole situation.

3. Consider all transaction costs. Arbitrage is when you buy futures and sell the asset on the spot market. This can be profitable, but don't forget about the costs: commissions, storage, delivery. If you don't take them into account, your profit can turn into a loss.

4. Follow the movement of futures towards the spot price. Futures prices usually gradually approach the spot price. But if the market is falling, this can work against you.

If futures are trading cheaper than spot and the chart shows a steady decline in prices, the market is signaling a decline in demand. In such a structure, participants are more likely to open short positions, expecting the asset's value to continue to decline.

A separate group of strategies is related to arbitrage. The trader buys futures closer to expiration, accepts delivery of the goods, and sells them at the spot price if it is higher. The difference between the quotes generates income. It is precisely such transactions that are one of the factors that ultimately cause futures prices to rise to the spot level. The physical parameters of the transaction are taken into account: delivery volume, logistics, and storage costs.

During backwardation, futures prices gradually increase, striving to match the spot price. Therefore, participants working in long positions gain an advantage due to the natural movement of the contract towards the current market level.

Source: Coindesk.com

The role of technology in forecasting backwardation

Modern technology has significantly changed the way traders assess the futures market. Algorithmic systems, machine learning, and big data analysis make it possible to track price structures, identify anomalies, and determine when futures begin to deviate from spot values.

Such tools process statistics faster than humans: demand dynamics, trading volumes, changes in logistics indicators, seasonal fluctuations. Based on this data, models show the probability of the market transitioning to a backwardation state or remaining in its current state.

Thanks to such methods, traders get a more accurate picture of current conditions and can assess in advance how the futures curve will change. This allows them to build positions taking into account market shifts, rather than just visual analysis of the chart

In conclusion

Backwardation reflects how the market distributes supply and demand over time and what prices participants expect in the future. The structure of the futures curve can be used to understand where the market sees a deficit, where there is a surplus, and in which direction expectations are currently shifting.

However, backwardation is not an independent signal. It is influenced by a combination of factors: seasonality, storage costs, changes in demand, supply disruptions, and the actions of major participants. Therefore, it cannot be considered a direct instruction for opening a position. It is only one element of the overall picture that helps to more accurately assess market conditions and price dynamics.

Subscribe and get access to the GoMining course on cryptocurrency and Bitcoin, which is still free: https://academy.gomining.com/courses/bitcoin-and-mining

January 5, 2026