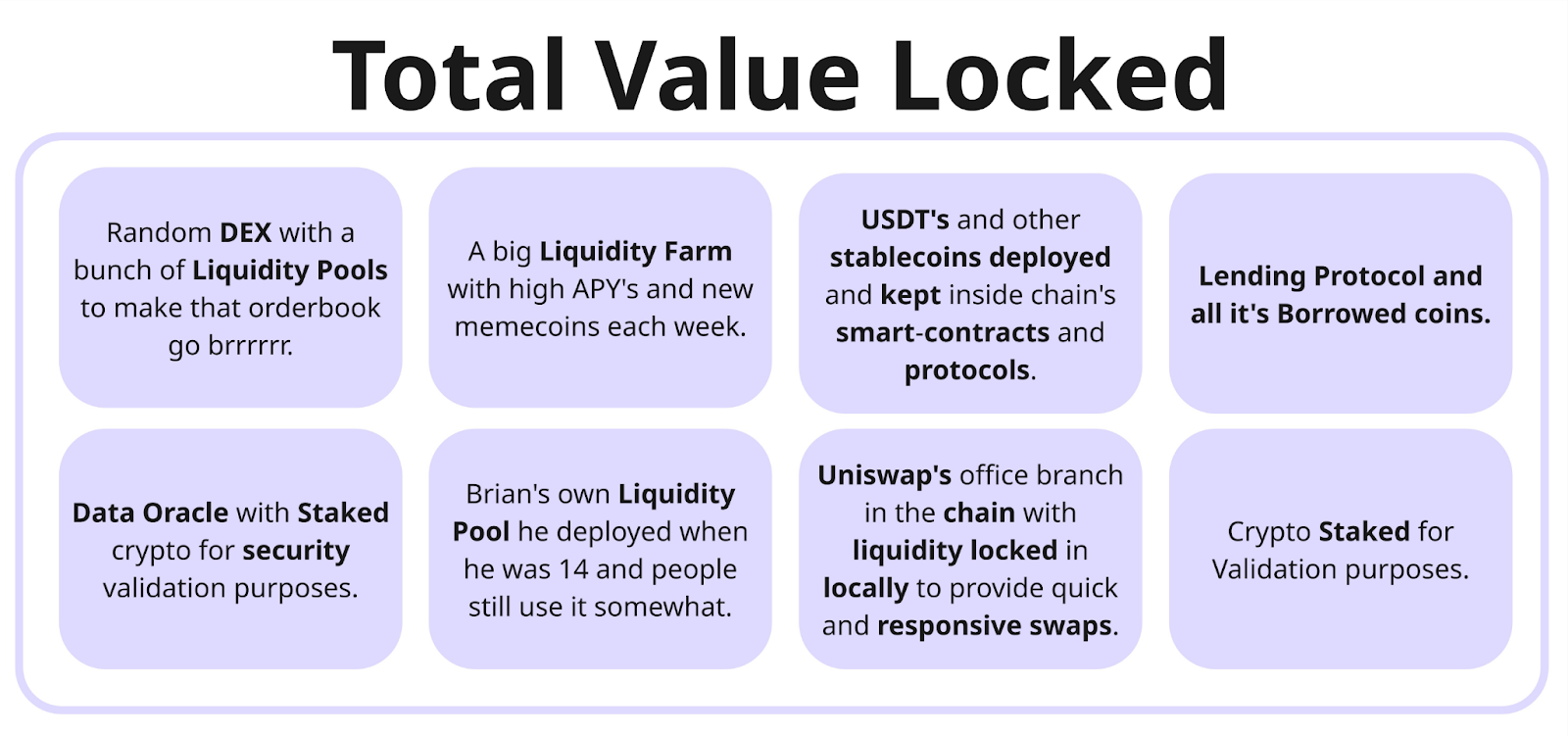

Total Value Locked (TVL) in the cryptocurrency sector is an indicator of the total amount of cryptocurrency on a single blockchain within all of its smart contracts.

Essentially, TVL shows how much money users have locked into the DeFi infrastructure, whether it be liquidity pools, staking mechanisms, lending platforms, or any other instruments that require capital to be locked up.

This metric serves as a key benchmark for assessing the health and sustainability of decentralized projects. Growth in TVL usually indicates increased user interest, expanded liquidity, and growing confidence in a particular protocol. The greater the volume of locked assets, the higher the value and influence of the platform on the DeFi ecosystem, as large amounts demonstrate the willingness of participants to invest their funds and support the operation of the protocol.

Source: GoMining

How is TVL determined?

The TVL indicator is based on the total value of all digital assets that users have locked into the smart contracts of a particular DeFi protocol or decentralized service. Despite its simple logic, the calculation requires several components to be taken into account:

1. The amount of funds deposited. The calculation includes all assets that participants have placed in the protocol: cryptocurrencies, project tokens, liquidity in pools, funds involved in staking, lending, and other mechanisms with capital lock-up.

2. Conversion to a single monetary equivalent. To determine the final TVL value, each token amount is converted to its current market value. The final amount is usually expressed in US dollars, so the price of each asset is multiplied by its quantity.

3. Summing up assets across all networks. If the protocol is available on multiple blockchains, the total TVL includes information about all chains involved to get a complete picture of liquidity distribution.

TVL calculation example

Let's assume that 1,000 ETH is recorded in the protocol. At the current price of Ethereum at $2,823, the total TVL will be $2,823,000 — this is the result of multiplying the volume of coins by their market value.

1. Dynamism of the indicator. TVL changes constantly, as it depends on market fluctuations, user behavior, and asset prices. An increase in the value of ETH or an inflow of new funds increases the indicator, while a decrease in price or withdrawal of liquidity decreases it.

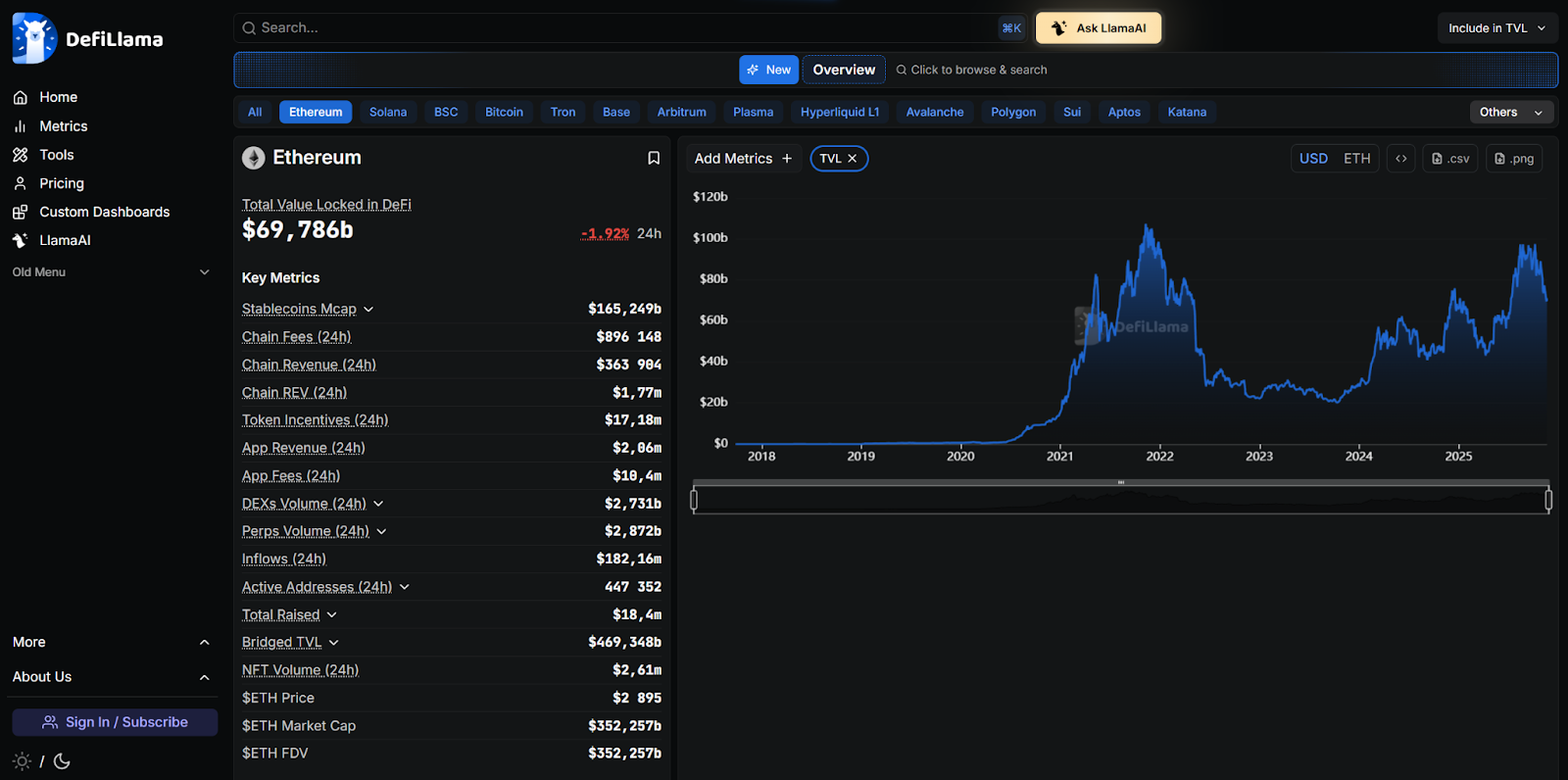

2. Where can you track TVL? Current data on the TVL of the Ethereum network can be conveniently tracked through analytical sites such as DeFiLlama, which provide statistics on liquidity, asset distribution, and the activity of various DeFi protocols.

Source:DeFiLlamaFactors affecting TVL

The amount of funds locked in DeFi protocols depends on many factors that can either contribute to TVL growth or reduce it under certain conditions. The main ones are:

1. Market value of assets and market conditions. TVL is closely linked to the price of cryptocurrencies and tokens held in smart contracts. When the value of assets increases, the total TVL increases, even if the amount of locked funds remains the same. Conversely, when prices fall, TVL decreases, reflecting market volatility and potential risks for users. Analyzing the list of cryptocurrencies by market capitalization helps to understand how price changes affect the role of specific tokens in protocols and the overall level of TVL.

2. Participant activity. The more users interact with the platform, through staking, providing liquidity, or lending, the higher the TVL. Attractive conditions, such as high interest rates or bonuses, encourage the influx of new participants and increase the total amount of locked funds.

3. Protocol improvements and new features. The introduction of new capabilities, functionality updates, and interface improvements attract user attention. Platforms that are constantly evolving and adapting to the needs of the community are able to maintain or increase TVL by retaining current participants and attracting new ones.

4. Marketing activities and promotional campaigns. Bonuses, promotions, and advertising campaigns can significantly influence TVL. They stimulate the influx of new users, increasing the amount of funds locked in the protocol and strengthening trust in the platform.

5. Security and trust in the protocol. A high level of security and transparency in the platform's operation are critical for retaining and attracting funds. Any incidents, hacker attacks, vulnerabilities, or questionable practices can sharply reduce TVL, as users will avoid risky protocols.

Why is TVL so important?

The total value of assets locked in a protocol is one of the key indicators for assessing the health of any DeFi platform. It reflects not only the amount of liquidity, but also the overall attitude of users towards the project. The main reasons for the importance of TVL can be summarized as follows:

1. Indicator of available liquidity. TVL shows how large the reserve of funds within the protocol is — it is from these assets that liquidity pools are formed, loans are issued, and trading operations are provided. The higher the amount of locked funds, the more opportunities users have to interact with the platform without significant liquidity drawdowns.

2. Reflection of the level of trust and interest of the community. Large amounts placed within smart contracts indicate that market participants are confident in the project and are not afraid to lock up significant capital there. This contributes to the growth of the protocol's reputation and stimulates the influx of new users.

3. A marker of system stability. A high TVL usually means that the project has a sufficiently large financial cushion to weather market volatility. Such protocols are better able to withstand sharp price changes and can continue to function even under adverse conditions.

4. A factor influencing the interest of large investors. Institutional and professional investors often look at TVL when choosing promising DeFi platforms. A high locked value creates an impression of reliability and high activity, which makes the project more attractive. It also allows the platform to offer competitive terms: improved commissions, bonus programs, increased limits.

5. Assessment of progress and development. For development teams, analysts, and researchers, TVL is an indicator that allows them to track the growth dynamics of a project. Protocols that demonstrate a steady increase in TVL are usually perceived as developing and promising market players.

The significance of Total Value Locked in the DeFi ecosystem

In the world of decentralized finance, TVL is considered one of the key criteria for assessing the viability and liquidity of a particular protocol. While in the traditional financial system, the level of liquidity is determined by the amount of capital concentrated in banks and institutions, in DeFi, everything works differently. Here, the main benchmark is the amount of funds that users voluntarily lock in smart contracts.

A high TVL value indicates that ecosystem participants trust the platform, are willing to lock up their assets for potential returns, and actively use the protocol's products — such as staking, participating in liquidity pools, or credit mechanisms.

TVL is not only a measure of liquidity, but also an indicator of the stability and demand for a project. The more funds are under the protocol's management, the more confident users and investors are that the system will withstand market volatility, continue to develop, and be able to expand its financial instruments. A high TVL also contributes to the growth of the platform's popularity among new participants, creating a positive trust effect and accelerating the development of the entire project.

In conclusion

Understanding the significance of TVL allows for an objective assessment of the stability and growth potential of cryptocurrency protocols. This indicator serves as a benchmark for users who want to determine where their capital can yield the highest returns. TVL is useful not only for investors but also for all participants in the DeFi ecosystem who are looking for the most profitable and secure platforms for interacting with decentralized services.

Subscribe and get access to the GoMining course on cryptocurrency and Bitcoin, which is still free: https://academy.gomining.com/courses/bitcoin-and-mining

November 27, 2025